September 30th is Coming: Are You Ready for the Post-PHE Medicare Waiver Landscape?

As a digital health policy expert, the phrase "September 30, 2025" sends shivers down our spines – and likely yours too, if you’re operating in the telehealth space. This isn't just another date on the calendar; it's the precipice of the Public Health Emergency (PHE) Medicare waivers. For years, these waivers have been the bedrock of expanded virtual care access, allowing providers unprecedented flexibility. Now, we face a critical juncture.

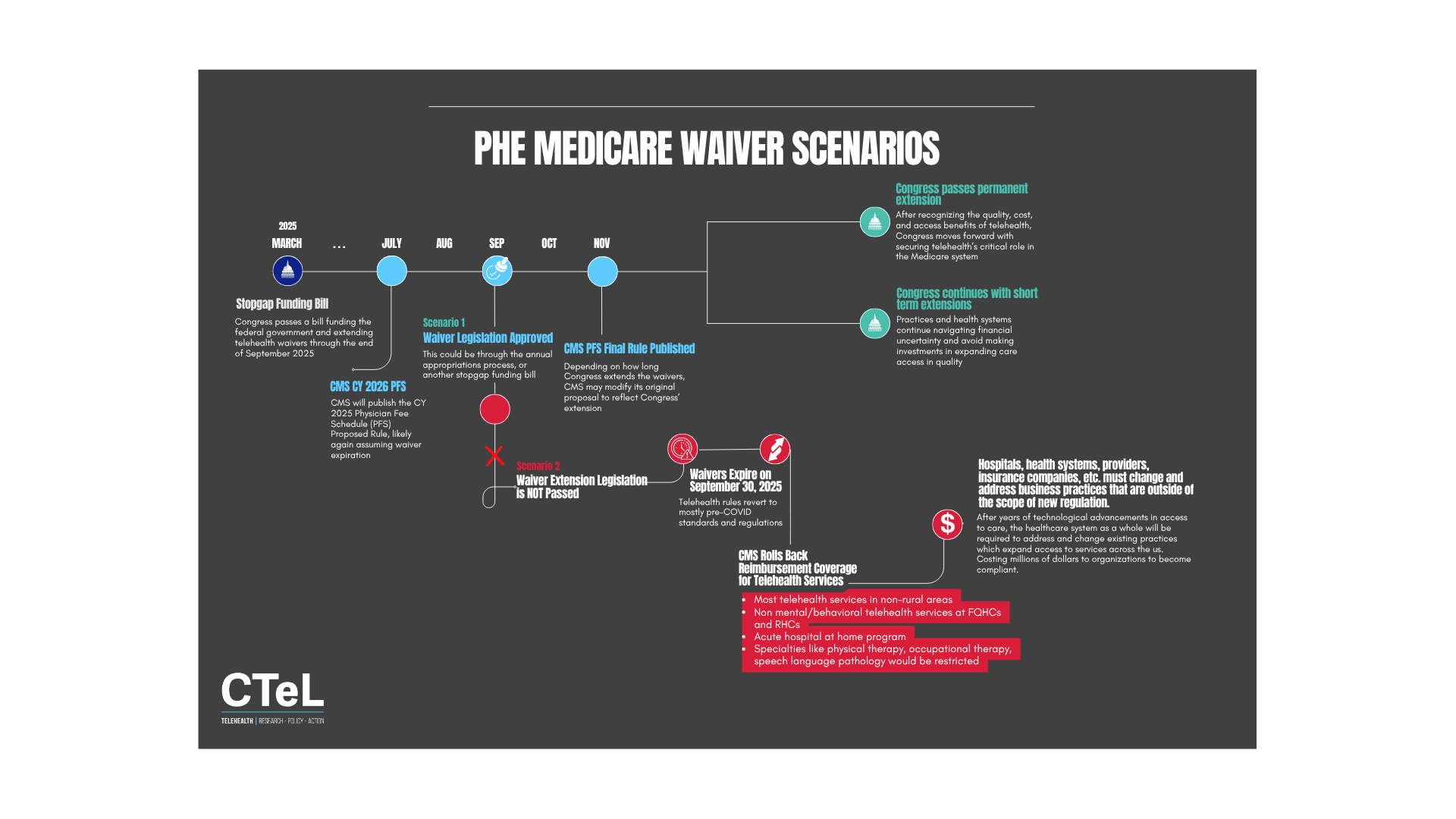

The stopgap funding bill in March 2025 bought us some time, pushing the waiver expiration to September 2025. However, this temporary reprieve, coupled with CMS's recent May 2025 draft of the CY 2025 Physician Fee Schedule (PFS) Proposed Rule – which will undoubtedly initiate discussions around waiver expiration, signals that the clock is ticking.

What happens next will fundamentally reshape the digital health ecosystem.

As we stare down this "telehealth cliff," it's crucial to analyze the potential scenarios and their implications for different stakeholders. CTeL’s insights, based on years of deep diving into congressional action, regulatory frameworks, and market dynamics, suggest a bifurcated future.

Scenario 1: Congressional Action – A Glimmer of Permanence or Extended Certainty (The Ideal)

"Scenario 1: Waiver Legislation Approved" in July 2025, ideally leading to Congress passing a "permanent extension." This is the future we all hope for. Permanent authorization of key telehealth flexibilities would signal a clear commitment from policymakers to embrace virtual care as an integral part of healthcare delivery.

Alternatively, "Congress continues with short-term extensions" could buy us more time, allowing for further data collection and policy refinement. While not ideal, it would prevent an abrupt rollback.

Impact under Congressional Action:

Large Health Systems: With permanent or extended waivers, large systems can continue to strategically invest in robust telehealth infrastructure, integrate virtual care seamlessly into their care pathways, and expand service lines like "hospital at home" without fear of reimbursement shifts. This allows for long-term planning, workforce development, and value-based care initiatives that leverage virtual platforms. Research consistently shows that integrated telehealth improves patient access and reduces readmissions.

Providers: Individual practitioners and group practices would maintain the ability to deliver care virtually across state lines (where applicable), bill for services at parity, and expand their patient panels. This stability is critical for burnout prevention and fostering a more agile healthcare workforce.

Direct-to-Consumer (DTC) Companies: A permanent extension would allow DTC companies to continue innovating and expanding their reach, particularly in areas like mental health and chronic disease management. They could further solidify partnerships with traditional healthcare entities, blurring the lines between virtual and in-person care.

Mental and Behavioral Health: This sector has arguably benefited the most from telehealth expansion. Permanent waivers would ensure continued access to critical mental health services, especially for underserved populations. The ability to conduct virtual therapy sessions and medication management without geographic restrictions has been a lifeline for many (American Psychological Association, 2023).

Vendors/Startups: Predictability fuels innovation. With sustained telehealth reimbursement, digital health vendors and startups would see continued investment, allowing them to refine platforms, develop AI-driven tools, and integrate with electronic health records more effectively. This scenario encourages market growth and strategic partnerships.

Scenario 2: Waiver Extension Legislation IS NOT Passed – The Telehealth Cliff (The Challenging Reality)

This is the "telehealth cliff" we must prepare for. If no legislative action is taken, the CMS Final Rule Published in October 2025 will likely reflect the pre-PHE reimbursement landscape, triggering significant "CMS Rolls Back Reimbursement Coverage for Telehealth Services."

Specific Reimbursement Rollbacks Identified by CTeL:

Telehealth services in non-rural areas.

Non-experimental telehealth services at FQHCs and RHCs.

Acute hospital-at-home programs.

Certain services (e.g., physical therapy, occupational therapy, speech-language pathology) would be restricted.

Impact under No Congressional Action:

Large Health Systems: This scenario demands immediate and drastic recalibration. Systems will need to revert to pre-PHE billing rules, which could significantly impact revenue from virtual visits, especially for patients outside rural areas. "Hospital at home" programs, often a hallmark of innovation, would face severe reimbursement challenges. Strategic divestment from certain virtual programs or a complete redesign of care delivery models might be necessary. This could lead to a two-tiered system, with disparities in access for urban vs. rural patients.

Providers: The burden on individual providers would be immense. Billing complexities would increase, and the scope of practice for virtual care would shrink. Many providers, especially those who invested heavily in telehealth during the pandemic, may need to reduce virtual offerings or face financial instability. This could exacerbate workforce shortages and clinician burnout.

Direct-to-Consumer (DTC) Companies: DTC companies would be hit hard. Their business models often rely on broad geographic access and parity reimbursement. They would need to pivot rapidly, focusing on cash-pay models, exploring employer-sponsored programs, or deeply integrating with health systems that can navigate complex billing. This could lead to consolidation or even market exits for some.

Mental and Behavioral Health: This sector would experience a severe contraction in access. The rollback of geographic restrictions would mean many patients, particularly those in underserved areas or those with mobility issues, would lose access to their established virtual therapists. This could worsen the ongoing mental health crisis, especially for vulnerable populations.

Vendors/Startups: Investment in digital health would likely cool, particularly for solutions heavily reliant on Medicare reimbursement. Companies would need to demonstrate value beyond traditional fee-for-service, focusing on alternative payment models, population health, or direct-to-employer offerings. Mergers and acquisitions might accelerate as companies seek to consolidate resources and diversify.

Proactive Strategies for the Approaching Deadline

Regardless of the scenario, there is a universal truth: "Hospitals, health systems, providers, and organizations must adapt and address new practices that are outside of the scope of new regulation." This means:

Advocacy is Paramount: Continuously engage with policymakers. Share data, evidence, and patient stories that highlight the value of telehealth. Join CTeL and our membership as we are actively working towards for permanent flexibilities.

Data-Driven Decision Making: Collect robust data on telehealth utilization, outcomes, patient satisfaction, and cost-effectiveness. This evidence is crucial for advocating for policy changes and for making informed strategic decisions within your organization.

Explore Alternative Payment Models (APMs): Consider moving beyond fee-for-service. Value-based care models, bundled payments, and direct contracting arrangements can offer more flexibility for virtual care delivery, independent of specific Medicare waivers.

Optimize Operational Efficiencies: Whether waivers persist or expire, efficiency is key. Streamline workflows, leverage technology for automated scheduling and patient intake, and train staff for hybrid care models.

Diversify Revenue Streams: For all entities, relying solely on Medicare fee-for-service is risky. Explore commercial payer contracts, employer partnerships, and direct-to-consumer offerings (where appropriate and compliant).

Conclusion: A Pivotal Moment for Digital Health

The next few months are pivotal for the future of digital health. The September 30, 2025, deadline for PHE Medicare waivers looms large. While congressional action for a permanent extension remains the most desirable outcome, preparing for a potential rollback of reimbursement is not just prudent—it's essential for survival and continued innovation. Organizations that proactively adapt, leverage data, and advocate for sustainable telehealth policies will be the ones that thrive in the evolving landscape of virtual care. The future of healthcare access and innovation hinges on our collective ability to navigate this crucial moment effectively.

References

American Psychological Association. (2023). Telehealth: The new normal for mental health care. Retrieved from https://www.apa.org/monitor/2024/01/trends-telehealth-new-normal-technology

CTeL (Center for Telehealth & e-Health Law). (May 2025). PHE Medicare Waiver Scenarios.